No products in the cart.

Financial Freedom, Financial Planning, Insurance for tax saving, LIC

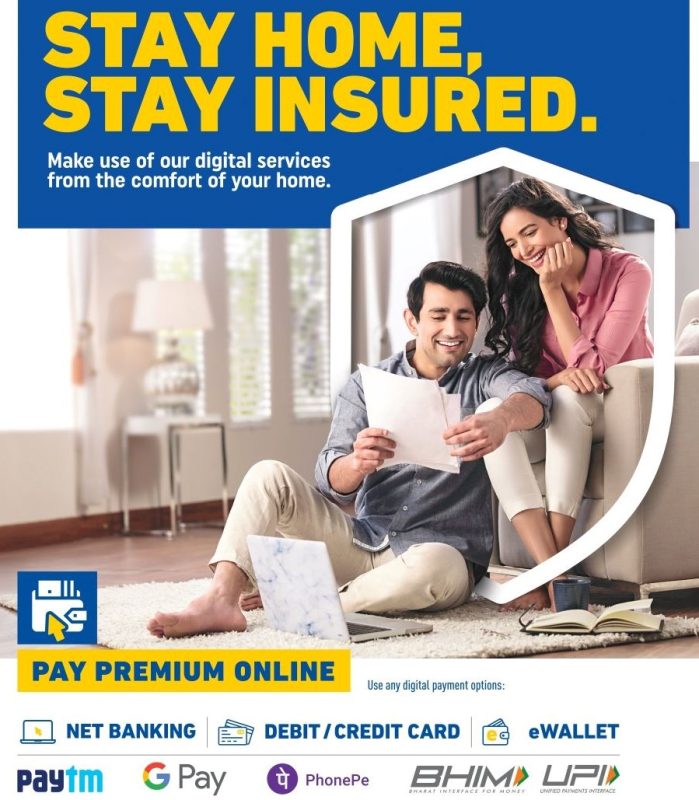

Can I buy LIC policy online

Top 5 LIC Plans to invest in 2021

Let us have a look at the Top 5 LIC plans to invest in 2021.

Yes, You can buy LIC policy online.

LIC policies can now be purchased online using netbanking, credit card, UPI etc

LIC is the leading Insurance company in India and has a strong customer base of more than 250 million. LIC is the most trusted Insurance brand and is also the world’s largest insurance company. When so many millions of people trust the brand LIC, the insurance company offers extensive range of plans to suit the needs of many different people and its vast customer base.

LIC Jeevan Umang

Jeevan Umang is currently to most popular policy of LIC. It has many features in a single policy. It is a whole life pension policy. The policy offers life cover along with accidental and disability rider during the policy premium paying term. After the premium paying term the policy holder receives lifelong assured pension equal to 8% of the sum assured. After the death of policyholder, the nominee also receives a lumpsum amount as settlement. To top it all, the pension and the death benefit are tax free. With bank interests at an all time low, LIC Jeevan Umang is the best LIC plan you can invest in right now for assured benefits.

LIC Jeevan Labh

Jeevan Labh is one of the best selling endowment plan from LIC. All LIC policies cater to different needs of the policyholder. It has flexible terms to choose from. You can invest in it as a short term plan for 10 years with 15 years maturity or plan long term with maturity at 25 years. Jeevan Labh also promises a higher bonus rate of Rs.50 every 1000 sum assured as a result of which the maturity returns are higher compared to other plans. With a limited premium payment in LIC Jeevan Labh, you also enjoy life cover without premium payment for an extended term.

LIC Jeevan Anand

LIC Jeevan Anand has continued to be the best selling LIC plan since a few decades. Jeevan anand is a whole life endowment policy. With double maturity this is a go to plan for many first time investors. Jeevan anand offers life cover upto 100 years. Policy holder receives lumpsum at maturity and continues enjoying life cover without premium payment for life time. Policyholder can choose to surrender policy at 70th year and receive maturity or continue for lifelong cover.

LIC Jeevan Tarun

LIC Jeevan Tarun is a child plan designed keeping current trends in mind. With more and more people opting for higher education, Jeevan Tarun helps you plan your finances for your child’s education. As a parent, you have to pay the premium until your child turns 20. After that LIC takes care of the financial need for education with jeevan tarun by giving periodic payout from 20th year to 25th year. In case of an unfortunate incident of death of the parent, then the future premiums are waived off, while the child continues to enjoy the policy benefits.

LIC Money Back Plan

Money back plan are the most convenient policy, where people are looking for life cover, tax saving and also their money not being locked for a long period. With LIC Money back plans you have the option of getting a certain amount back every 5 years. LIC money back plans also offer 5 years extra life cover without premium payment. This is the most suitable plan for working women as it offers a lot of flexibility

Top

5 plans to invest in LIC

www.licindia.in is the official website for LIC